Student Loans

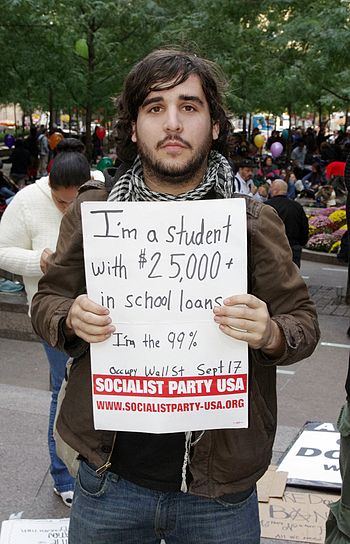

The student loan crisis has been getting considerable attention in the media, but the coverage is often quick and shallow. James B. Steele and Lance Williams of Reveal from the The Center for Investigative Reporting have presented a more in-depth examination of the student loan industry. As a former student and current professor, I am concerned about student loans.

The original intention of student loans, broadly construed, was to provide lower income students with an affordable means of paying for college. Like most students, I had to take out loans to pay for school. This was back in the 1980s, when college costs were more reasonable and just as student loans were being transformed into a massive for-profit industry. As such, my loans were fairly modest (about $8,000) and I was able to pay them off even on the pitiful salary I was earning as an adjunct professor. Times have, however, changed.

Making a long story short, the federal government enabled banks and private equity companies to monetize the federal student loan program, enabling them to make significant profits from the loans and fees. Because many state governments embraced an ideology of selfishness and opposition to public goods, these governments significant cut their support for state colleges and universities, thus increasing the cost of tuition. At the same time, university administrations were growing both in number of administrators and their salaries, thus increasing costs as well. There was also an increase in infrastructure costs due to new technology as well as a desire to market campuses as having amenities such as rock climbing gyms. The result is $1.3 trillion in debt for 42 million Americans. On the “positive” side, the government makes about 20% on its 2013 loans and the industry is humming along at $140 billion a year.

While the government holds about 93% of the total debt, the debt collection was contracted to private companies and these were scooped up by the likes of JPMorgan Chase and Citigroup. As would be expected, these contractors profit greatly—about $2 billion per year. The collection process is often very aggressive and the industry has used its control over congress to ensure that the laws are very favorable to them. For example, student loan debt is one of the very few debts that are not discharged by a bankruptcy.

While student loans were originally intended to benefit students, they now benefit the government and the private contractors to the detriment of students. As such, there is a moral concern here in addition to the practical concerns about loans.

If the primary purpose of student loans is to address economic inequality by assisting lower income students attend college, then its current state is a clear violation of this purpose. This is because the system is creating massive debt for students while creating massive profits for the government and private contractors. That is, students are being exploited by both the state and the private sector. The collusion of the state makes seeking redress rather difficult—after all, the people need to turn to the state for redress, yet the state is an interested party and under the influence of the industry. This problem is, of course, not unique to student loans and it is one more example of how privatization is great for the private sector but often awful for citizens.

It could be argued that this is the proper function of the state—to serve the interest of the financial elites at the expense of the citizens. If so, then the student loan program should continue as it is; it is great for the state and the financial class while it is crushing citizens under mountains of debt. If, however, the state should serve the good of the citizens in general, then the status quo is a disaster. My view is, not surprisingly, that of John Locke: the state is to serve the good of the people. As such, I contend that the student loan industry needs to be changed.

One change that would help is for states to return to supporting public higher education. While there are legitimate concerns about budgets, education is actually a great investment in both the private good of the students and the public good. After all, civilization needs educated people to function and people with college degrees end up with higher incomes and thus pay more taxes (paying back the investment many times over). While there are professed ideological reasons for opposing this, there are also financial motivations: dismantling public education would push more students into the awful for-profit schools that devour money and excrete un(der)employed people burdened by massive debt. While this is great for the owners of these schools, it is awful for the students and society as a whole.

Another change, which has been proposed by others, is to change or end the privatized aspects of the system. While there is the myth that the private sector is vastly superior to the inefficient and incompetent state, the fact is that the efficiency of the private sector seems to mostly lie in making a profit for itself rather than running the student loan system in accord with its intended purpose. This is not to say that the state must be great in what it does, just that cutting out the large profits of the collection agencies would reduce the burden on students. This is, of course, a moral question about whether it is right or not to profit on the backs of students.

There has also been talk about reducing the interest rates of student loans and even proposals for free college. I do favor lower interest rates; if the purpose of the loans is to assist students rather than make money, then lower interest rates would be the right thing to do. As far as free college goes, there is the obvious problem that “free” college has to be paid for by someone—it is a matter of shifting the burden from students to someone else. As far as the ethics of such a shift, it depends on who is picking up the tab.

As a closing point, there is also the matter of student responsibility. My loans went entirely to paying education expenses—which is one reason my debt was rather low even for the time. While many students do use the loans wisely, my experiences as a student and a professor have shown that students sometimes use the loan money unwisely and put themselves into debt for things that have no connection to education. For example, faculty often joke that while the administrators drive the best cars, the students drive the second best and the faculty drive the worst. Students that overburden themselves with loans they use irresponsibly have only themselves to blame. However, the fact that some students do this does not invalidate the claim that much of the debt burden inflicted on students is unjust.

6 comments